As previously reported, most professionals and college educated are over saving for their retirement years, and in so doing, are forgoing other beneficial life experiences earlier that they may not be able to do when older.

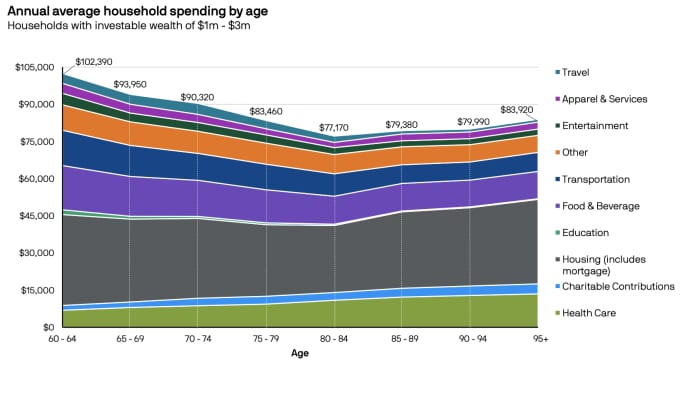

Retirement planning assumes that spending will stay constant or increase over time, during retirement. In reality, spending tends to drop as we get older and less mobile due to aging.

The effect is many people over save for retirement and would potentially have been better off obtaining life experiences that may have proved helpful in their careers, or just been fun when done younger in life.

Source: Are you saving more than you need for retirement? – MarketWatch

A frequent news story is that Americans are not saving enough for retirement. This is likely true, albeit in some cases, misleading. As the NBER study authors found, most college educated workers are making enough money that they can postpone retirement savings until their 40s. Many skilled workers have similar incomes and personal finances to the college educated and this applies to those workers too.

We frequently see charts showing how much has been saved, by age group.

Compounding interest is the reason many argue to begin saving for retirement as soon you start work in your 20s. This strategy no longer makes sense to many economists:

When it comes to saving money, many economists offer somewhat counterintuitive — and, dare I say, potentially irresponsible — advice: if you’re young and on a solid career track, you might consider spending more and saving less right now.

That’s because you’re likely going to earn a bigger paycheck when you’re older, and to really squeeze the enjoyment out of life, it might make sense to live a bit beyond your means at the moment and borrow from your future, richer self. Economists call this “consumption smoothing,” and it’s a feature of standard economic models of how rational people save and invest over their lifetime. The idea, Choi says, is “you don’t want to be starving in one period and overindulged in the next. You want to smooth that over time.” The sort of ideal scenario: you start off adulthood saving little or nothing or even taking on debt, then you save a lot during your prime-age earning years, and then you spend those savings when you retire.

An economist studied popular finance tips. Some might be leading you astray : Planet Money : NPR

When young, save your money for a down payment to purchase real estate (rather than saving for retirement when you are 23 years old) – including your home so that you can begin to accumulate wealth from property appreciation. But do not over buy! Buy what you need, not a huge mansion with a big mortgage!

At young ages, you may get a better overall return on investment by investing in your own education or skills, starting a new business – or investing in real estate.

Most people see their incomes rise substantially from their 20s to their 40s. With higher incomes in their 40s, it is easier to set aside more money for retirement – plus, if you did invest in skills, business or real estate when younger, you now have that “nest egg” generating good cash flow.

The key is to not focus on saving – but focus on financial discipline to achieve specific goals. Once you reach the point where savings makes sense, then you will have already established the habits to achieve these new goals of a future retirement.

And finally, by not over saving when in your 20s and 30s, you can take part in life experiences that may prove valuable to you in unexpected ways.

As I documented here an on my Travel blog, global skills and global thinking are essential to career success in many fields. Travel when young, study abroad options, and even work abroad – are activities more easily accomplished in your 20s than in your 40s when you own a home, a mortgage and two kids!

Those life experiences can translate into potential job benefits too – even if you do not work overseas, it is highly likely that as you advance in your career, you will end up supervising staff from other countries who are working here in the U.S. Having cross cultural skills and knowledge of differing lifestyles will help you become more effective.

International travel when young is a potential investment – and a life experience that may yield tangible benefits (job options) and intangible benefits (skills, confidence) and a broader perspective on business or work opportunities, providing a “big picture” view that comes only from a global and cross cultural perspective.

[…] Possibly: “Are you saving more than you need for retirement?” – Coldstreams […]